Passage 12Questions 8-12

● Read the article below about loans for business.

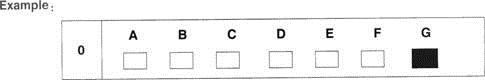

● Choose the best sentence from the opposite page to fill each of the gaps.

● For each gap (8—12), mark one letter (A—G) on your Answer Sheet.

● Do not use any letter more than noce.

● There is an example at the beginning, (0).

Loans for Business Loans for business refer to the loans available to the business owners of all sizes who need financial assistance to expand their business. Business loans are generally used for business start-up, business growth or business enhancement. (0)______ Almost every businessman takes loans for business at the critical moment, because it is very obvious to need additional financial resources at various stages of business development.

There are various kinds of loans available to the business owners. They have to just pick the right one keeping in mind their own requirements, specific needs and personal capabilities of repaying the loans. (8)______. So, every loan request from the business enterprises should bear proper documentation showing the growth prospect and the estimated profits of the business clearly.

Business loans can be availed from various resources. Among them Bank loans are very frequently taken by business owners. (9)______. For this reason maximum amount of loans granted by the bank goes to the large and established business houses.

It is somewhat difficult for the small businesses or the start-up businesses to acquire business loans from banks. (10)______. As these loans come with no limit on the loan amount and can be availed at easy terms and conditions, these are ideal business loans for a small business or for a business yet to be started. If a business owner succeeds in assuring the government about the authenticity and profitability of the business in using a well designed business plan and if the business owner has no criminal record, then it is not a difficult task to avail a Government loan. Government also provides some special loans to the elderly people who want to start a business and also to the minority people for a new business setup.

(11)______.These loans from business organizations are generally granted after considering the target market and the growth potential of the business. There is also another type of business loans which are termed as Micro Loans. These loans are small loans especially for the small and the start-up businesses. On submission of proper business plan including estimated financial profit, these Micro loans are granted to the small business enterprises and new business ventures. (12)______. Other business loans which are not frequently used but should be mentioned are franchise loans and export financing. Franchise loans are those business loans which are given by franchise companies or the loans availed under the help of franchise companies. Export Financing encourages lenders to give working capital loan by ensuring the repayment of the loan within due time. A. Loans for business can also be taken from other large business houses at the cost of indulging in a partnership with them.

A. Loans for business can also be taken from other large business houses at the cost of indulging in a partnership with them.

B. It is Government loans that are best suited for small businesses.

C. Whatever the size of the business is, the lenders always verify the actual purpose of the loan and the viability or profitability of the business before giving any loan.

D. Generally this kind of business loan is used buying inventory and paying operating expenses.

E. But the eligibility criterion for this loan is that, the aspiring business owner must complete business training.

F. But it is very difficult to impress banks and it needs extensive documentation of business growth plan.

G. Business loans can also be used for further capital investment in business and refinancing business debt.

Sometimes buyers only purchase some , tangible or intangible.

You can have eggs or hard-boiled.

Goods are carried by several of transport--on road or rail, by sea or air.

Prices may change quickly if supply or demand .

免费的网站请分享给朋友吧